How Paul B Insurance can Save You Time, Stress, and Money.

Whether you have a bronze health strategy, a high-deductible health and wellness strategy, or a Medicare Part C strategy, they will certainly all drop under these basic classifications. We'll explain the primary kinds of health and wellness insurance policy and instances. One of two primary kinds of medical insurance, public wellness insurance coverage is provided with a government program, like Medicare, Medicaid, or CHIP.

Just like personal health and wellness insurance policy plans, which we'll chat about next, government health insurance coverage programs attempt to take care of top quality and expenses of care, in an effort to supply lower costs to the insured. They might not be as high as with various other types of insurance coverage.

Medicaid and also CHIP are run by each state. While there is no registration period, there are monetary demands to qualify. You can get going with this state-by-state guide to Medicaid. Discover much more about exactly how health insurance functions. Any kind of wellness insurance coverage that's not gotten through a federal government program is considered exclusive health and wellness insurance, the other major kind of medical insurance.

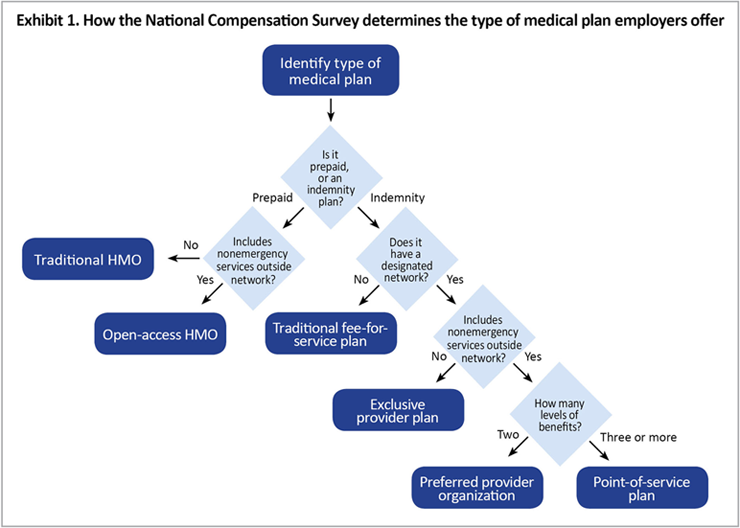

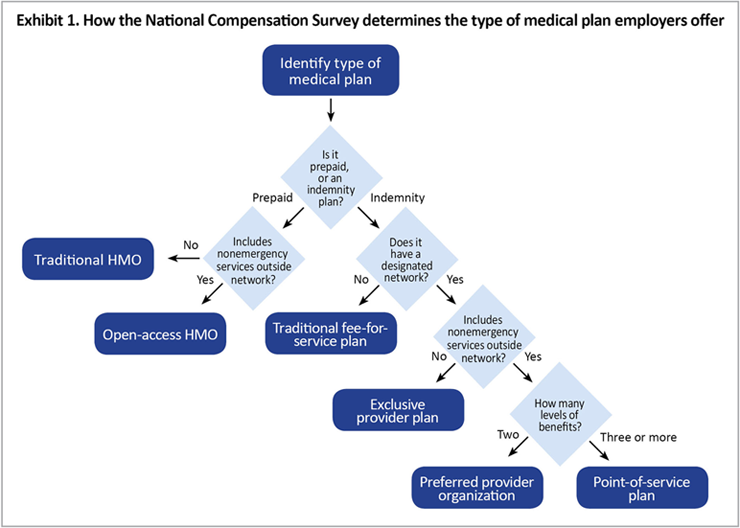

After you have actually established the primary type of medical insurance based upon its source, you can better categorize your protection by the sort of plan. Most health and wellness insurance coverage plans are handled treatment strategies, which merely suggests the insurance provider deal with different medical service providers to develop and also negotiate prices and top quality of care.

More About Paul B Insurance

Yet the deductibles, and other out-of-pocket costs like copayments as well as coinsurance for a health insurance plan will differ based upon your insurance firm as well as just how much treatment you seek. A high-deductible health insurance (HDHP), which makes it possible for the insured individual to open up an HSA account, may be an HMO with one insurer, and also an EPO with an additional.

Some sorts of wellness insurance, like short-term plans, do not offer detailed coverage as described by the Affordable Care Act as well as hence are not managed by it either. Brief term health and wellness insurance policy is not considered a kind of significant clinical insurance, but only a stopgap procedure implied to cover a couple of, yet not all, medical expenses. Still, picking wellness insurance coverage can be effort, also if you're selecting a plan through your employer. There are a lot of complicated terms, and also the procedure pressures you to concentrate regarding your health and wellness as well as your funds. Plus you have to navigate all of it on a target date, often with only a few-week period to discover your options and also choose.

Asking yourself a couple of easy questions can assist you zero in on the appropriate plan from all those on the marketplace. Below are some ideas on where to look as well as how to get trustworthy guidance as well as aid if you require it. It's not always obvious where to seek wellness insurance.

It's funded by both the government and also state federal governments, but run by each state, so whether you're qualified depends on where you live. For practically every person else, the area to go is Healthcare. gov, where you can go shopping for insurance coverage in the industries developed by the Affordable Care Act, also called Obamacare.

Examine This Report on Paul B Insurance

In Austin, Texas, "we had 76 plans to examine with customers," says Aaron De, La, O, director of health and wellness efforts with Foundation Communities. Despite lots of choices, you can tighten points down with some fundamental questions, De, La, O says. Ask on your own: "Do you [ simply] desire insurance coverage for that catastrophic occasion that might take place, or do you recognize you have a health and wellness concern now that you're mosting likely to require ongoing treatment for?" If you're rather healthy, any of a variety of strategies could function.

"If there's a plan that does not have your service provider or your drugs in-network, those can be eliminated," he claims. Occasionally you can go into in your drugs or medical professionals' names while you look for plans online to filter out strategies that will best site not cover them. You can also just call the insurance provider as well as ask: Is my provider click over here now in-network for this strategy I'm considering? Is my medicine on the strategy's formulary (the list of medications an insurance plan will cover)? There are likewise two major various sorts of plans to think about.

A Health care Company has a tendency to have a stringent network of service providers if you see a company beyond the network, the costs are all on you. A Preferred Company Organization "will offer you a lot wider option of companies it may be a bit extra pricey to see than an out-of-network service provider, but they'll still cover several of that cost," she discusses.

If you picked that plan, you would certainly be wagering you will not need to utilize a great deal of wellness services, therefore would just need to fret about your ideally budget friendly costs, and the prices of a couple of appointments. If you have a chronic medical problem or are merely even more risk averse, you may instead select a plan that has called up the amount of the premium.

Paul B Insurance Fundamentals Explained

This way, you can go to a great deal of appointments and get a great deal of prescriptions and still have manageable regular monthly prices. Which plans are offered and economical to you will vary a lot relying on where you live, your revenue and that remains in your home and also on your insurance plan.

Still feeling bewildered with all the ACA options? There is free, unbiased expert aid available to assist you choose as well as enroll in a plan. Aaron De, La, O is one such navigator, and also keeps in mind that he and his fellow overviews don't work on commission they're paid by the government.

gov or your regional state department of insurance coverage to find someone that's check licensed and in excellent standing." The web can be a scary area. Corlette says she warns individuals: Do not put your call info in medical insurance passion kinds or click on-line ads for insurance! The strategies that often tend to surface when you Google "I need health and wellness insurance policy" can seem enticing since they're frequently very cheap but they could likewise be "brief term" strategies that do not cover basic things like prescription medications or annual check ups.

"However, there are a whole lot of con artists out there who take advantage of the fact that individuals recognize health and wellness insurance is something that they ought to obtain," states Corlette. She informs individuals: "Just go straight to Healthcare.

Paul B Insurance Things To Know Before You Buy

This year, the register period for the Health, Treatment. gov market intends that go into impact in January 2022 starts Nov. 1, 2021 as well as runs till Jan. 15, 2022. If you're signing up for an employer-sponsored strategy or Medicare, the target dates will be different, yet most likely additionally in the fall.